Post-Covid Economy and Market Volatility

Post-Covid Economy and Market Volatility

by Valerie L Peck, CFP®

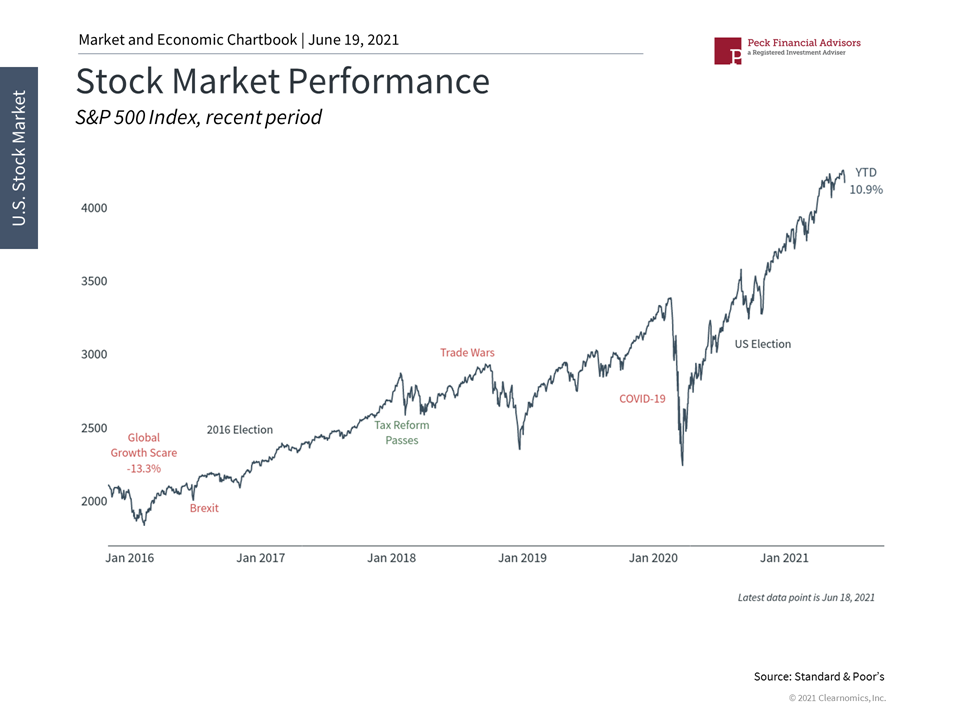

The stock market has rallied significantly over the past year. Despite reaching many new all-time highs, uncertainty remains high due to the recovery and rising interest rates. Stock market volatility is a normal and unavoidable part of investing. The reason we as investors are rewarded over time is because we are willing to stomach risk, especially when it is least expected. For long-term investors, it is important for us to maintain the proper perspective and look past short-term volatility. Many measures confirm the ongoing economic recovery. Air travel is nearly back to pre-pandemic levels and restaurant activity in many parts of the country are nearing a full recovery. At this stage, corporate earnings have returned to pre-pandemic levels at least two quarters faster than originally expected. Consensus estimates suggest that earnings could continue to accelerate into 2022 as demand heats up, fiscal policy stimulates the economy, and monetary policy keeps financial conditions loose.

Many measures confirm the ongoing economic recovery. Air travel is nearly back to pre-pandemic levels and restaurant activity in many parts of the country are nearing a full recovery. At this stage, corporate earnings have returned to pre-pandemic levels at least two quarters faster than originally expected. Consensus estimates suggest that earnings could continue to accelerate into 2022 as demand heats up, fiscal policy stimulates the economy, and monetary policy keeps financial conditions loose.

This economic rebound has driven corporate profits back to their 2019 year-end levels. Earnings are expected to continue to grow as demand heats up. As investors, keeping a diversified portfolio can allow us to participate in this growth and help protect on the downside.