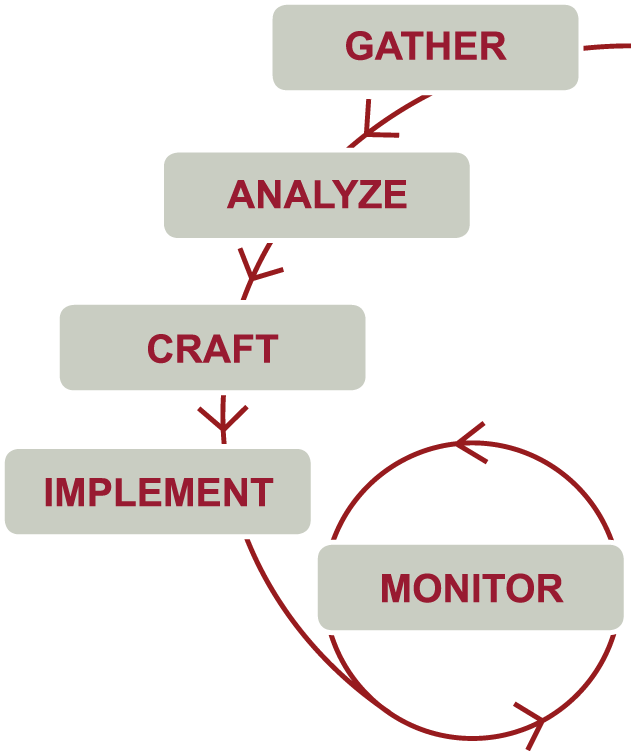

Our Process

Peck Financial Advisors offers fee-only advisory services that help navigate the cycles and transitions of the markets and our financial lives. Our goal is to build lasting relationships with our clients to help manage assets, expectations and opportunities.

- GATHER – We work with you to identify the priorities, concerns, resources and liabilities that need to be considered when establishing a long-term plan

- ANALYZE – We analyze your situation, look at “what-if” scenarios, and model ways you can potentially achieve your goals and weather the challenges you face.

- CRAFT YOUR PLAN – We review the plan with you to be sure it aligns with your vision and works in a way that you can live with in the long-term.

- IMPLEMENT – We work with you to implement the plan, not only to allocate your assets but to be sure you’re addressing the cash flow, estate planning and risk management issues that can affect you and those important to you.

- MONITOR – On an ongoing basis, we monitor your situation to determine what’s working and what’s not. We construct a plan that evolves as your life evolves, making adjustments that keep you on track for your priorities.